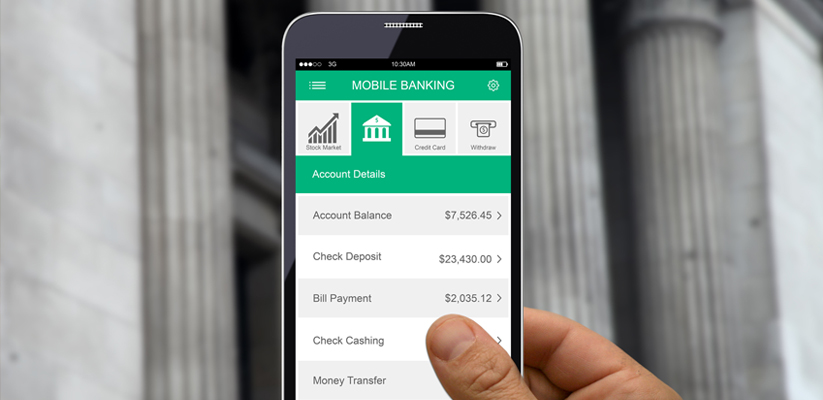

How to Create an Advanced Functional Mobile Banking App for Customer Satisfaction

The year 2015 showcased a major shift in the evolution of mobile banking. In US, the number of mobile banking app users topped the count of those appearing in-person at branches, according to a report published by Javelin Strategy & Research. The trend is facilitating the engaging use of mobile apps over physical channels of crowded banks. Javelin also predicts that the digital medium will become the main player in allowing users to form opinions and an image about their financial institution. The move will greatly enhance the cost of failure. However the concern arises how to create a mobile banking app that can promote a better than ever customer satisfaction?

Some financial institutions may not be equipped to develop mobile apps on their own. Rather they can opt to hire a top and quality mobile app development service provider to cater their needs at best.

1. Incorporating seamless transactional experience

Seeking a favorable customer feedback is always appreciated, but is not always an easy job to accomplish. Enhancing the functionality of a mobile app is simply much more than adding a couple of new buttons, but rather calls for a smooth use along with the features that clearly communicates the institution’s benefits and offerings to clients.

To cater this, banks need to ensure their app is well-run with seamless transactional experience. Some popular successful examples are: the companies in FinTech started to present themselves as “convenience providers”, and Rocket Mortgage’s introduction of “push a button, get a mortgage” offers a quick online mortgage application. The point is to incorporate a feature that offers the quickest way for making an online transaction.

2. Assign a one-touch access to customer support

Many top institutions focus on enabling smooth online account management to satisfy customer’s needs, while failing to register the importance of sufficient customer support. A normal route asks the customer to close the app in order to access the FAQ page or filling out of an online request form. The time taken can easily turn off the interest of even a potential client, not to mention switching to a more efficient and customer-oriented service provider if matter worsens. This is how developers can capitalize by offering the one-touch solution where customers can directly travel to the customer support page without abandoning the app.

3. Engineering intuitive user navigation

In most cases, many successful mobile apps largely focus on adding a simple and highly intuitive navigation feature allowing user to save time. For instance, Ally bank has put in a virtual assistant that throws instructions and guidance to customers seeking help in performing transactions.

4. Better financial management

A core mobile banking app can further strengthen by attaching a financial analyzer displaying user-friendly charts and graphs showing figures of income, expenses, and overall investment performance. Additional thoughts could be to add business banking and related aspects in the app.

5. Applying customer data to include personalized options

Customers tend to produce monstrous amount of personal data on daily basis from which the banks can greatly avail. Adding personalized reminders and notifications as per customer profile are excellent workarounds. For instance, banks can send an alert to a customer whose account balance has dropped below a minimum limit, or when a withdrawal cash exceeds a defined limit. But do see the incorporation of such features should be case-based and used intelligently. For example, it does not make any sense to send a reminder to a client who is acquiring a financial institution’s bond when the maturity date has expired already. This is what the developers should consider by giving strong thoughts on reminders and notifications from all angles. Further use of customer data can be by making specific suggestions for loans, home-refinancing chances, debt management, etc.

Conclusion

As understood, customer satisfaction requires some real investment in efforts and well-planned strategies by making the mobile banking app as convenient and attractive as possible. While the inclusion of all the above features will only make your app more powerful than ever where customers can manage a plethora of their financial needs all in a single app.

Warning: count(): Parameter must be an array or an object that implements Countable in /home/appabilities/public_html/blog/wp-includes/class-wp-comment-query.php on line 405